With more programs available, there’s a higher likelihood that one of them could help you reach your homeownership goals

Are you thinking about the possibility of purchasing a home in Staten Island, N.Y.? With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible, whether on the Island, or elsewhere in the nation; and one thing you’ll want to be aware of is just how much the number of down payment assistance (DPA) programs has grown lately.

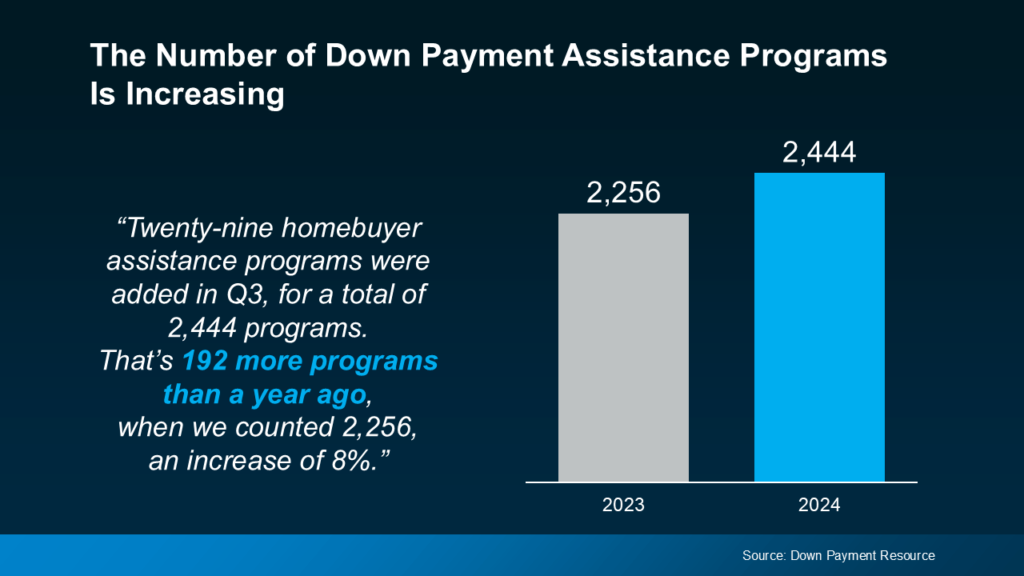

Take a look at the graph below to see how many new programs have been added in the last year, according to data from Down Payment Resource:

More Programs, More Opportunities for You

So, what does this increase mean for you? With more programs available, there’s a higher likelihood that one of them could help you reach your homeownership goals.

And these programs aren’t small-scale help either – the benefits can go a long way toward covering a chunk of your costs. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine being able to qualify for $17,000 toward your down payment — that’s a big boost, especially if you’re looking to buy your first home. With that level of help, buying a home may be more within reach than you think.

But it’s worth calling out that the growth in DPA options isn’t just focused on first-time and first-generation buyers. Many of the new programs are also aimed at supporting affordable housing initiatives, which include manufactured and multi-family homes. This means that more people, and a wider variety of home types, can qualify for down payment assistance, making it easier for you to find an option that fits your needs.

On Staten Island, Talk to a Real Estate Expert, a Realtor subscriber of the Staten Island Multiple Listing Service Inc. (SIMLS) to Discuss What’s Available for You

With so many DPA programs out there, you need to make sure you’re finding the right one for you. On Staten Island, as elsewhere, it’s key to lean on your real estate and lending professionals for guidance. The Mortgage Reports says:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Your Staten Island Realtor or loan officer will know what’s available in your area and can point you toward programs that align with your goals.

Bottom Line

With more down payment assistance programs than ever before, now’s a great time to explore how these options can help on your homebuying journey. It’s advantageous to work with a Realtor subscriber of the Staten Island MLS to make sure you have a team of expert advisors in place to see which DPA programs may best suit you.

###

The information contained, and the opinions expressed in articles, videos, or infographics posted or shared by the Staten Island Board of Realtors® (SIBOR) and/or the Staten Island Multiple Listing Service Inc. (SIMLS) are not intended to be construed as investment advice. SIBOR and SIMLS do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. SIBOR and SIMLS will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.