Interest rates for a 30-year fixed rate mortgage climbed consistently throughout 2018 until the middle of November. After that point, rates returned to levels that we saw in August to close out the year at 4.55%, according to Freddie Mac’s Primary Mortgage Market Survey.

After the first week of 2019, rates have continued their downward trend. As Freddie Mac’s Chief Economist Sam Khater notes, this is great news for homebuyers. He states,

“Mortgage rates declined to start the new year with the 30-year fixed-rate mortgage dipping to 4.51 percent. Low mortgage rates combined with decelerating home price growth should get prospective homebuyers excited to buy.”

In some areas of the country, the combination of rising interest rates and rising home prices had made some first-time buyers push pause on their home searches. But with more inventory coming to market, continued price growth, and interest rates slowing, this is a great time to get back in the market!

Will This Trend Continue?

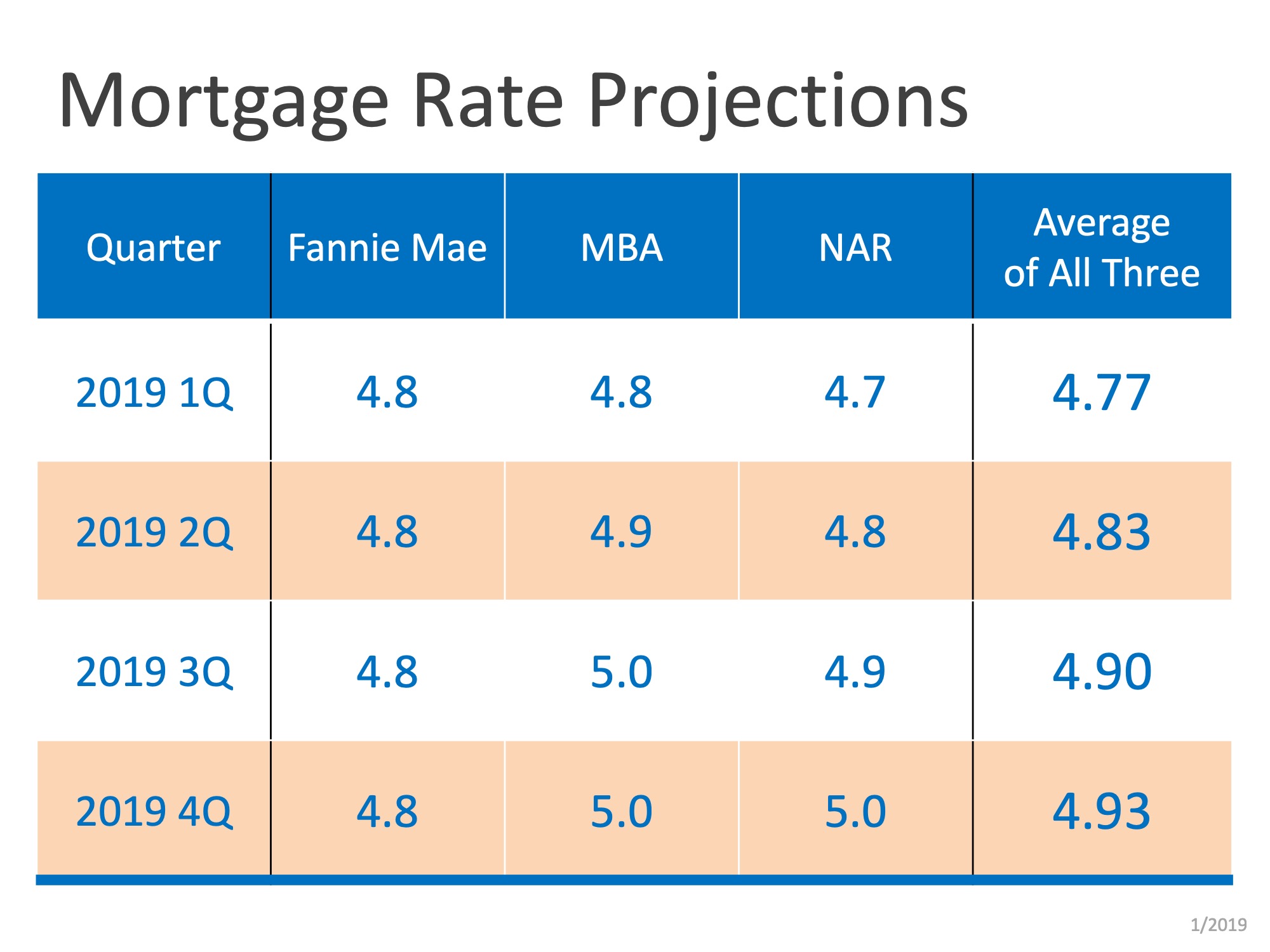

According to the latest forecasts from Fannie Mae, the Mortgage Bankers Association, and theNational Association of Realtors, mortgage rates will increase over the course of 2019, but not at the same pace they did in 2018. You can see the forecasts broken down by quarter below.

Bottom Line

Even a small increase (or decrease) in interest rates can impact your monthly housing cost.

The information contained, and the opinions expressed, in articles or videos posted or shared by The Staten Island Board of Realtors® (SIBOR) are not intended to be construed as investment advice. SIBOR does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. SIBOR will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.